In december congress extended the residential energy efficient property credit through the end of 2016 which included tax credits for energy star metal roofing.

Metal roof energy credit 2016.

You must have a manufacturer s certification statement to take the credit.

This provides a new marketing opportunity for the metal roofing industry as this is the first time in several years that the tax credit isn t just retroactive but is guaranteed for the current year.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

10 of cost note.

There is a total combined credit limit of 500 for all purchases improvements for all years since 2005.

Metal roofs with appropriate pigmented coatings and asphalt roofs with appropriate cooling granules that also meet energy star requirements are eligible.

Homeowners can receive a tax credit of 10 of the cost up to 500 for interlock metal roofing systems installed on their principal residence.

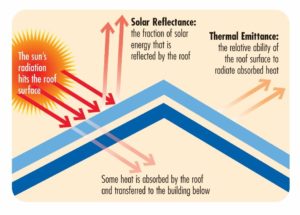

Qualified metal roof products reflect more of the sun s rays which can lower roof surface temperature by up to 100f decreasing the amount of heat transferred into your home.

Learn more and find products.

If you installed an energy star certified roof you can take a tax credit using form 5695 residential energy credits.

A tax credit reduces the amount of tax owed so it s different from a tax deduction rebate or refund.

This is great news for homeowners wanting a tax break for making a smart investment in a new roof.

Government approved a 500 tax credit for qualifying metal roofs installed in 2015 and 2016.

Homeowners may qualify for a federal tax credit for installing certainteed energy star qualified roofing products.

Use energy saver s reference list below to see if you are eligible for qualifying credits when filing irs tax form 5695 with your taxes.

At the end of 2016 the clock runs out on several federal tax credits for homeowners who made energy upgrades during the year.

Summary of tax credit under the bipartisan budget act of 2018 which was signed in february 2018 a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed.

If you are not eligible to take the credit.

The energy star metal roof tax credit was extended from december 31 2017 to december 31 2020.

Energy star tax credits reduce your tax liability dollar for dollar rather than a mere deduction which only removes a percentage of the tax that is owed so they are actually more.

This tax credit is for energy star certified metal and asphalt roofs with pigmented coatings or cooling granules designed to reduce heat gain.